There are a range of factors affecting the Australian property market. While the country’s economic and financial outlook faces many challenges in 2023, it could be viewed that there are also some pockets of opportunity.

In this article, we discuss some of these challenges and opportunities further.

In 2021, the residential property market experienced extraordinary growth fuelled in part by a post lockdown bounce-back. However, much lower volumes of residential property came to the market in 2022. This slowdown was due to a combination of interest rate hikes and rising inflation.

Currently, these factors continue to create a level of uncertainty in the marketplace, moving forward, the market in general will hinge on the effects of interest rate rises.

A combination of further increases in interest rates and low consumer confidence could continue to have downward impact on the market. Further to this, around 60% of record-low fixed-term mortgages are set to expire this year. This will see these loans expiring into an environment from 1-2% rates to 5-6% variable rates.

This will apply pressure in the following areas:

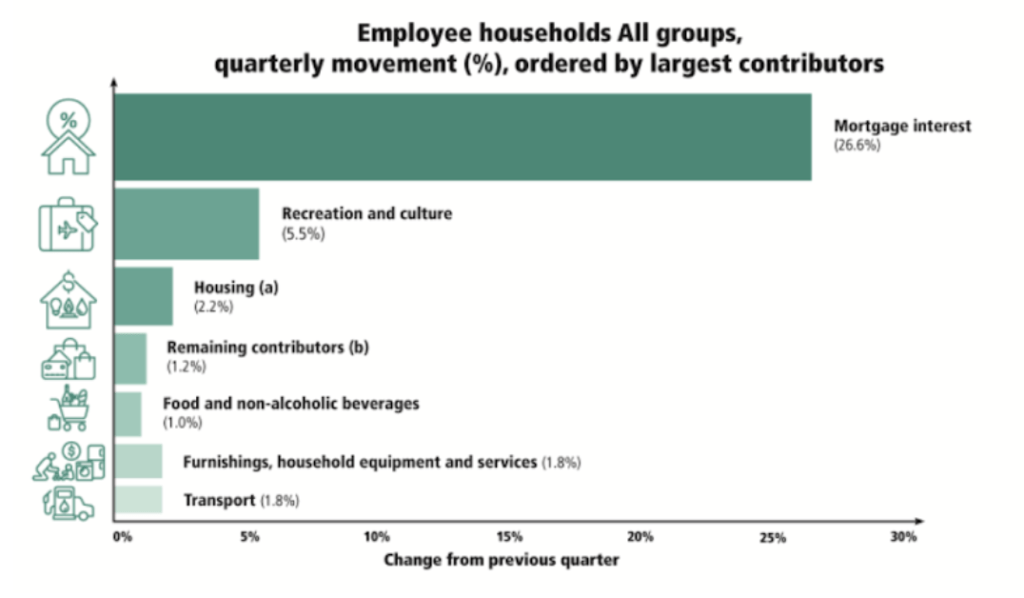

1) Consumer Spending – as people have to reprioritise their budgets to afford a change in loan repayments (see Chart 1 Below: ABS Changes in December Quarter 2022)

CHART 1

2) Lifestyle – as pressure is applied to spending, lifestyle sacrifices may need to be made.

3) Affordability of Property – any prospects of acquiring new assets and property may reduce, which in turn will potentially reduce some demand for property in certain areas. This could have the impact of then creating downward pressure on pricing.

4) Inability to hold existing property and debt – there could be some cases where more properties come to market where the gap becomes too great in between rent yields andbank loan repayments i.e. negatively geared properties could become unaffordable. This could create more supply of properties to the market and once again place downward pressure on demand.

As a general side note, construction has slowed down in terms of new offerings to market due to affordability of construction and time delays from trads and supplies being unavailable. The will assist with relieving some supply pressure in these areas.

Overall, the changes in rates (both for fixed loans expiring and rising rates) will be a major test for the stability of the housing market around the country. While the majority of homeowners will still be able to sell their homes, there may be some additional supply hitting the market as people need to sell which would likely put further downward pressure on Australian housing prices. Residential property markets in Australia are known for their changing property price cycles.

While overall the Australian property market is in a downturn, not all the nation’s property markets are being impacted equally. Each State is at its own stage of the property cycle and within each capital city there are multiple markets with property values falling in some locations, stable in others and there are a few locations where housing values are still rising. We are currently in what market commentators refer to as the adjustment phase of the property cycle. Some commentators believe

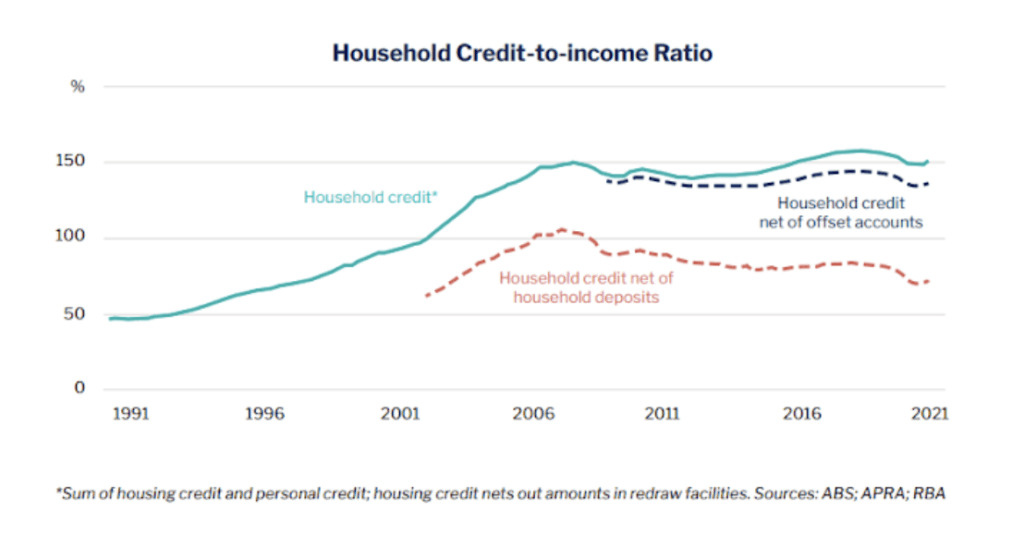

this correction had to occur after house prices across the country got ahead of themselves. By both historical standards and global standards, household debt to household income in Australia, had risen to significantly high levels, driven largely by the size of mortgage debt held by households (See chart 2 below). Despite rising interest rates, they are likely going to get to where they were pre-pandemic and borrowers could cope then, albeit the level of average debt has now risen per household. Another factor that would cause a significant downturn is when unemployment levels are high, however that is not the case in Australia currently.

Working in the office and from home has had a complete shift since the COVID pandemic. The change of the way people work resulted in a vast amount of office space going empty. As a result, despite large incentives, a sizeable volume of office space remains vacant or below capacity, particularly in periphery CBD locations. While it’s unlikely the hybrid working preferences will change significantly in 2023, some experts are predicting these office spaces will be repurposed with plans for high-density residential apartments and student accommodation as well as childcare centres and

warehouses moving in.

The expectation of rural areas outperforming for Commercial investments is prevalent in statements and reports released by the Real Estate Institute of Australia’s (REIA). The report suggests regional markets offer comparative growth opportunities for both rents and yields as interstate migration patterns continue to evolve. While rising energy prices will have a major impact on outgoings, the OECD is forecasting Australia’s

economy to outperform many other advanced economies. As international migration resumes at significant scale, with an anticipated 235,000 people set to call Australia home next financial year, REIA president Hayden Groves, says the changing factors offer a unique set of opportunities and challenges for the commercial property market in 2023. Providing insights on how the commercial sector will fare given these conditions, the REIA has said that while the risk premium on commercial property is tight, the sector should return to supply/demand rebalance relatively quickly as supply slows over the next few years and demand strengthens. The report also noted that energy-efficient buildings with great base building offerings and tenant amenities still offer good long-term value for investors. Another factor that would cause a crash is when unemployment levels are high, however that is not the case in Australia.

The Savills Australia 2023 Spotlight research report suggests that commercial property investment will bounce back in 2023, with one of the main drivers including clearer outlooks for interest rates.

In any portfolio, there are benefits to be gained by considering a diversified approach to

investments. Holding all assets in one sector can void your portfolio of the benefits of liquidity and a multi-pronged approach to investments and flexibility. Furthermore, the structuring and ownership of your investments can play an important role in your current and future outcomes after tax. It is equally important to consider what ownership structure will meet your short and long term goals.

We suggest a review with your Financial Adviser and Accountant to consider and determine what is the best way for you to diversify to meet your goals and what is the best ownership structure taking into account short, medium and long term plans for your investments.

Please contact us on 1300 ELITE 0 to take advantage of your complimentary health check. www.elitewealth.com.au | support@elitewealth.com.au

This information is current as at February 2023 and is subject to change. As this information (including the statements on taxation which are of a general nature only and based on current laws, rulings and interpretation) has been prepared without considering your objectives, financial situation or needs, you should, before acting on this information, consider its appropriateness to your circumstances.

EliteWealth Management is a corporate authorised representative of PGW Financial planning (AFSL 384713). You should consult with your financial adviser before selecting any insurance or investment products. The information provided in this article is general in nature and any personal advice to meet your personal objectives would need to be provided on an individual basis.

Elite Wealth Management (AR 1296131 ABN 50688637647) is a Corporate Authorised Representative of PGW Financial Services Pty Ltd (AFSL 384713 ABN 15 123 835 441). Jolene Sukkarieh (AR 300103) is an Authorised Representative of PGW Financial Services Pty Ltd AFSL 384 713 ABN 15 123 835 441

References:

https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/selected-living-cost-indexes-australia/latest-release

https://reia.com.au/wp-content/uploads/2023/02/REIA-MEDIA-RELEASE_LENDING-STATS_030223.pdf